153 rows Capital gains are included as part of income and taxed at the individuals. Motor vehicles are taxed from 0 to 80 percent.

Fluyez Fluyez Twitter In 2021 Memes Sayings Millionaire

2 The taxes which are the subject of this Convention are.

Bolivia capital gains tax. Capital gains realized from selling real property to individuals are taxed at the individual tax rate of 13. Bolivian legislation does not include specific regulations for capital gains. The capital gains tax rates shown in the map are expressed as the top marginal capital gains tax rates taking account of imputations credits or offsets.

A in the case of the United Kingdom. Immovable property as well as taxes on capital appreciation. Alcoholic beverages are subject to a lump sum tax per liter.

In arriving at effective capital gains tax rates the. 28 28 paid in advance returned after 1 year 10 on distribution of profit 9 zero tax for annual income under 863333 44. There are no concessions to short-term foreign residents.

The United States places a relatively high burden on long-term capital gains income gains on assets held for more than one year. Its capital city is Sucre. And iii the capital gains tax.

I the income tax. CAPITAL GAINS Capital gains earned by nonresidents through selling a Bolivian property are taxed at corporate income tax rate of 25. The sale of real estate is not subject to VAT.

24 standard rate 13 health and tourism services 6 theater tickets books and medicine For some islands away from the mainland the rates are 17 9 and 4 respectively. Employers have the obligation to withhold and pay to the tax authorities the RC-IVA on gross income after deduction of social contributions and other concepts established by tax law. 225 capital gains over R30 million.

An employee is taxed on salaries bonuses except Christmas bonus living allowances housing allowances tax reimbursements benefits in kind and any other form of incomecompensation earned as an employee for work carried out in Bolivia. Value Added Tax VAT. Capital gains are not subject to tax.

Rental income taxes. The taxable income is the net rental income deemed to be 50 of the gross rent. 20 capital gains between R10 million and R30 million.

Personal income tax rates. Domestic and foreign see Taxable income and Tax rates. Chapter 3 - Tables 37 to 314 - Taxes as of GDP and as of Total tax revenue Chapter 3 - Table 315 - Tax revenues of subsectors of general government as of total tax revenue Chapter 4 - Countries - Tax revenue and of GDP by level of government and main taxes.

The tax levied on the average annual income on a rental apartmentproperty in the country. Collection of Bolivia capital Its A 27 letters crossword definition. Net capital gain is presumed to be 50 of the gross gains.

In addition taxpayers with AGI over 200000 250000 married filing jointly are subject to the 38 percent Net Investment Income Tax. Income tax on indirect transfer. Capital gains tax rate.

VAT Stamp duty. Successfully defended mining company Compañia Minera Tiwanacu in litigation concerning the payment of capital gains tax after selling a 78 stake worth 19m in an affiliated company to a Canadian entity. B in the case of Bolivia.

People are now accustomed to using the internet in gadgets to see image and video information for inspiration and according to the name of the. Capital gains are taxed by the income tax. 13 125 effective tax rate for individuals engaged in a profession or business activity Residence.

Ii the corporation tax. Capital gains realized from selling real property to businesses and professionals are taxed at the corporate tax rate of 25. Provides ongoing tax advice to regional development bank CAF.

The personal income tax Regimen Complementario del Impuesto al Valor Agregado or RC-IVA rate is 13. The top federal tax rate is 20 percent. It is a democratic republic that is divided into nine departments.

Capital gains taxes. Capital Gains Tax is imposed and collected on a self-assessment basis and the. 15 capital gains up to R5 million.

Capital gains on real estate property are in general taxable at 22 27 for commercial property. Capital gains must be included in annual CIT if they are considered Bolivian-source income and will be taxed at a rate of 25. Bolivia does not define the concept of residence.

If the capital gains tax rate varies in a country by type of asset sold the tax rate applying to the sale of listed shares after an extended period of time is used. Taxable gains are subject to a withholding tax rates on capital gains are as follows figures in Brazilian Reais R. The property is personally directly owned jointly by husband and.

An additional 0 to 10 percent tax on the sale price of. Individuals are subject to tax on Bolivia-source income unless the income is specifically exempt. Therefore the effective income tax rate is 125 on the gross rental income 25 tax on 50 of the gross income.

As we know it lately is being hunted by consumers around us perhaps one of you personally. Gross rental income is US1500month. Income tax on indirect transfer may apply if a non-resident entity is transferred provided that at least 30 percent of value of the entity is represented by assets located in Argentina and provided that the transferor owns at least 10 percent of the capital.

Acquisition price and improvement costs are deductible. Capital gains are not subject to tax. Finland and Ireland follow at 34 percent and 33 percent respectively.

Capital Gains Tax CGT It came into effect from May 1 2011 replacing the Land Sales Tax. The stamp duty is based on the higher purchase price and value assessed for tax purposes. However the government is based in La Paz.

Denmark levies the highest capital gains tax of all countries covered at a rate of 42 percent. Bolivia a landlocked country in South America is bordered by Brazil to the north and east by Argentina and Paraguay to the south and by Chile and Peru to the west. The capital gains tax rates shown in the map are expressed as the top marginal capital gains tax rates taking account of imputations credits or offsets.

175 capital gains between R5 million and R10 million. Hereinafter referred to as United Kingdom tax. Last reviewed - 08 July 2021.

Cigarettes and tobacco are taxed at the ad valorem rates ranging from 50 to 55 percent. Value Added Tax VAT The VAT is levied on the leasing of Bolivian real estate at the standard VAT rate of 13.

Rentabilidad Riesgo Y Liquidez Los Tres Ejes De La Inversion Business Loans Real Estate Investing Sketch Notes

French Guiana History Geography Facts History Geography Map Geography

Taxation Of Capital Gains In Developing Countries In Imf Staff Papers Volume 1968 Issue 002 1968

Rio Celeste Costa Rica Waterfall Volcano National Park River

Free Live Ncdex Rate Live Futures Quotes Live Price Low Data Usage 24rate In 2021 Future Quotes Quotes To Live By Quotes

Taxation Of Capital Gains In Developing Countries In Imf Staff Papers Volume 1968 Issue 002 1968

South Korea Plans To Invest Over 380m For Blockchain Research And Development Blockchain South Korea Korea

Taxation Of Capital Gains In Developing Countries In Imf Staff Papers Volume 1968 Issue 002 1968

404 Gurushots In 2021 Snow Dogs Dog Wallpaper Dog Sledding

Yeditepe Universitesi Http Isalimi Com Yeditepe Universitesi Html House Styles Mansions Home

/CIA_map_of_the_Caribbean-822e94431d4647ba9ca350ebf28eb23b.png)

Top 10 Offshore Tax Havens In The Caribbean

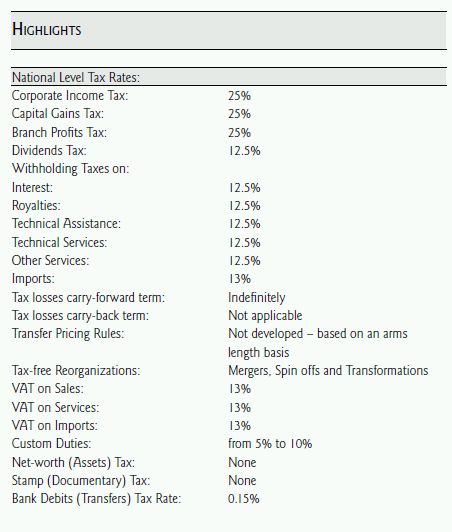

Managing Corporate Taxation In Latin American Countries Bolivia Tax Bolivia

Mapa De Ubicacion De Ecuador Mapa De Ubicacion Ecuador Bolivia Capital

With Rbi Keeping Interest Rates On Hold Quantitative Easing To Unfold Fitch Times Of India In 2021 Bank Of India Times Of India Icici Bank

Warren Buffett S Favorite Market Indicator Nears Record High Signaling Stocks Are Overvalued And A Crash May Be Coming In 2020 Stock Market Crash Warren Buffett Stock Market

Having Trouble Explaining Bitcoin Try These Cartoons Bitcoin What Is Bitcoin Mining Money Machine

Pin On Where To Invest After Bitcoin

Mapa De Ubicacion De Ecuador Mapa De Ubicacion Ecuador Bolivia Capital

ConversionConversion EmoticonEmoticon